Table Of Content

The amount may fluctuate if your county or city raises the tax rate or if your home is reevaluated and increases in value. This calculator doesn’t include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

How lenders decide how much you can afford to borrow

And if you’re an active military member or veteran, you can qualify for VA loans. Government-sponsored mortgages have lower credit score requirements compared to conventional loans. However, they come with private mortgage insurance (or funding fee for VA loans), which can make your monthly payment more costly.

What’s the purpose of a mortgage calculator?

The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. The loan term is the amount of time it will take to pay a debt.

Great! Based on your information, you may qualify for the rates and monthly payments listed below.*

Apart from government-sponsored loans, borrowers also have the option to take jumbo mortgages. This is useful if you need particularly large financing to purchase expensive property. As previously mentioned, jumbo mortgages are non-conforming loans that exceed the federal loan limits prescribed by the FHFA. These are offered by private lenders such as banks, non-bank mortgage companies, and credit unions. Before you lock in an interest rate, it’s worth knowing that high interest rates bring higher monthly payments and increase the amount of interest you’ll pay over the life of your loan.

It includes advanced features like amortization tables and the ability to calculate a loan including property taxes, homeowners insurance & property mortgage insurance. Keep in mind that you may pay for other costs in your monthly payment, such as homeowners’ insurance, property taxes, and private mortgage insurance (PMI). For a breakdown of your mortgage payment costs, try our free mortgage calculator. A mortgage calculator helps you estimate your monthly payments. When you use the Rocket Mortgage® calculator, it’ll factor in frequently overlooked costs like property taxes and homeowners insurance.

To help you out, we came up with a guide to help you understand different home financing options in the market. It mainly covers conventional loans and how they compare to other mortgages such as FHA loans, USDA loans, and VA loans. With this article, we hope to help you choose the right mortgage for your prospective home. The amount you pay each month for your mortgage, homeowner’s insurance, and HOA fees.

Consumer Loans

You can apply online or speak to a Home Loan Expert to get a better idea of how much you’ll pay after you close. Apply online for expert recommendations with real interest rates and payments. Homeowners insurance protects your property in the event of a break-in or natural disaster. It’s not a legal requirement, but your lender will likely require you to maintain a certain amount of insurance to fulfill the terms of your loan.

This depends on the size of your loan and if you make a downpayment. It also factors in the type of VA loan you take and if you’ve used your VA benefit before. Once you’ve used your VA benefit, the VA funding fee rate increases the next time you apply for a loan. Department of Veterans Affairs funding fee and closing costs page. A 30-year fixed-rate mortgage is the most common type of mortgage.

USDA loan (government loan)

Examples of other loans that aren't amortized include interest-only loans and balloon loans. The former includes an interest-only period of payment, and the latter has a large principal payment at loan maturity. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures.

Mortgage Calculator: PMI, Interest & Taxes - The Motley Fool

Mortgage Calculator: PMI, Interest & Taxes.

Posted: Thu, 09 Nov 2023 08:00:00 GMT [source]

To make sure you have low default risk, lenders carefully review your assets and liabilities. They may also call your employer to verify if you’re still employed. For self-employed applicants, you’ll need to provide additional documents as requested.

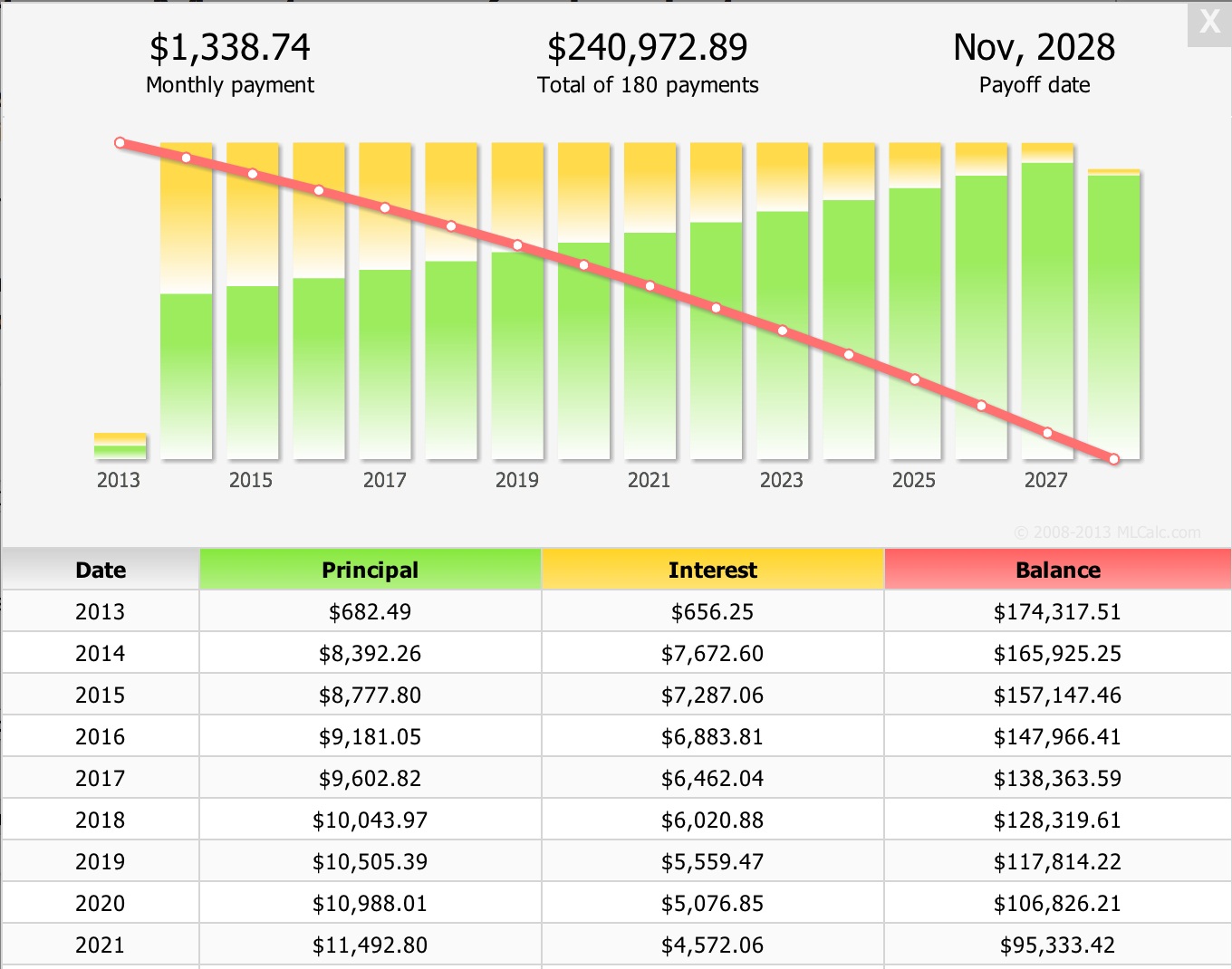

In contrast, a low interest rate saves you money in both the short and long term. When you make your monthly mortgage payment, part of your payment will go toward interest and the rest will be applied to the principal. In the beginning, most of your monthly payments will go toward interest. But over time, more and more of your money will go toward principal. Mortgage loan terms can vary, but most borrowers choose either a fixed-rate 15-year or 30-year mortgage.

No comments:

Post a Comment